Corporate Governance

The Directors submit their report together with the audited Consolidated and Parent Company Financial Statements of Salamander Energy PLC for the year ended 31 December 2012.

Salamander Energy PLC is the holding company of the Group and its issued ordinary shares were admitted to listing on the main market of the London Stock Exchange on 5 December 2006, under the designation SMDR.

Principal activities

The principal activities of the Group which are intended to continue into the future are as an independent oil and gas exploration, development and production company focused on building a portfolio of assets in Asia. The Group operates through a number of subsidiary and other undertakings, including Jointly Controlled Entities, which are set out in note 15 to the consolidated Financial Statements.

The Group’s head office is in London with regional offices in Singapore, Thailand and Indonesia.

Business review

The Company is required by Section 417 of the Companies Act 2006 to include a review of its business in this report. The information that fulfils this requirement is contained in the following sections of the Annual Report which are incorporated by reference and are deemed to form part of this Directors’ Report:

- Chairman’s and Chief Executive’s Review;

- Operational Review;

- Financial Review;

- Risk Management;

- Corporate Responsibility; and

- Corporate Governance Statement.

Directors

The Directors who served in office during the financial year and subsequently were as follows:

- Charles Jamieson (Chairman)

- James Menzies (Chief Executive)

- Struan Robertson (Senior Independent Non-executive Director)

- Carol Bell (appointed on 25 January 2012)

- Mike Buck

- Robert Cathery

- James Coleman (resigned on 22 June 2012)

- Jonathan Copus

- John Crowle

- Michael Pavia

With regard to the appointment and replacement of Directors, the Company is governed by its Articles of Association, the UK Corporate Governance Code, the Companies Act and related legislation. The Company’s Articles of Association give power to the Board to appoint Directors but require the Directors to submit themselves for election at the first Annual General Meeting (AGM) following their election and thereafter retire by rotation and offer themselves for re-election by shareholders at least every three years. owever, the Company is supportive of the recommendation from the UK Corporate Governance Code that all Directors annually stand for re-election. Accordingly, and as at the 2010, 2011 and 2012 AGMs, all Board members will offer themselves for re-election at the 2013 AGM.

A proposal will be put forward to shareholders at the 2013 AGM to amend the Company’s Articles of Association. These amendments will, inter alia, include a new provision requiring all Directors to stand for annual election by shareholders.

The powers of Directors are described in the Board’s Terms of Reference, copies of which are included on the Company’s website, www.salamander-energy.com and summarised in the Corporate Governance section of this report.

Results and dividends

The consolidated Financial Statements for the year ended 31 December 2012 are as set out in the Financial Statements. The Group’s loss after taxation for the year was $62.3 million (2011: post-tax loss of $45.5 million).

The Company has declared no dividend for the year ended 31 December 2012 (2011: nil). It is not the Directors’ current intention that the Company will pay a dividend for the foreseeable future.

Directors’ interests in shares

The Directors who held office at 31 December 2012 had the following interests in the ordinary shares of the Company:

| Beneficial Shares | ||

| At 1 January 2012 Number1 |

At 31 December 2012 Number1 |

|

| Charles Jamieson | 734,869 | 848,619 |

| James Menzies | 2,127,546 | 2,577,768 |

| Carol Bell (appointed on 25 January 2012) | – | 12,012 |

| Mike Buck | 366,750 | 771,176 |

| Robert Cathery | 450,000 | 537,500 |

| Jonathan Copus | – | 19,901 |

| John Crowle | 13,040 | 71,515 |

| Michael Pavia | 30,000 | 49,500 |

| Struan Robertson | 9,300 | 15,345 |

| 1 Or date of appointment, if later. | ||

As at 13 March 2013, the interests of the Directors in the ordinary shares of the Company were the same as reported at 31 December 2012. The above interests include those of immediate family members.

The shareholders of the Company have not specified any guidance with respect to Directors’ holdings of shares.

Capital structure and ordinary shares

Details of the Company’s issued share capital together with details of movements in share capital during the year are included in note 27 to the consolidated Financial Statements. The Company has one class of ordinary shares.

Details of employee share schemes are disclosed in the Remuneration Report and in note 28 to the consolidated Financial Statements.

On a show of hands at a general meeting (including any AGM) of the Company every holder of ordinary shares present in person and entitled to vote shall have one vote and, on a poll, every member present in person or by proxy and entitled to vote shall have one vote for every ordinary share held. The notice of general meeting specifies deadlines for exercising voting rights either by proxy or in person in relation to resolutions to be passed at the general meeting. All proxy votes are counted and the numbers for, against or withheld in relation to each resolution are announced at the general meeting and, in accordance with the current requirements of the UK Corporate Governance Code, will be published on the Company’s website after the meeting.

There are no restrictions on the transfer of ordinary shares in the Company other than:

- pursuant to the Listing Rules of the Financial Services Authority whereby employees of the Company require the approval of the Company to deal in the Company’s securities;

- pursuant to the Company’s various share scheme arrangements;

- certain restrictions may from time to time be imposed by laws and regulations (for example, insider trading laws and market requirements relating to close periods); and

- pursuant to Article 31 of the Company’s Articles of Association.

The purpose of Article 31 of the Company’s Articles is to restrict the percentage of Salamander Energy PLC shares that may be held by Canadian residents so as to enable the Company to rely on exemptions from certain obligations to which the Company may be subject under Canadian Securities Law. Article 31 of the Company’s Articles confers upon the Board the power to require Canadian citizens beneficially owning Salamander shares to transfer their Salamander shares when their aggregate shareholding approaches a 10% threshold. In the event that such Canadian Salamander shareholders are required to transfer their Salamander shares under Article 31, the relevant Salamander shares will be sold in the market at the best price reasonably obtainable in the market and the net proceeds (if any) will be remitted to the relevant Canadian Salamander Shareholder. This compulsory transfer power is generally available to the Board to exercise from time to time, and the Board is free to exercise this power in its absolute discretion. As the Company is no longer a reporting issuer in Canada such exemptions are no longer required and, accordingly, an amendment to the Company’s Articles of Association will be proposed at the 2013 AGM to remove Article 31.

The Directors are not aware of any agreements between holders of the Company’s shares that may result in restrictions on the transfer of securities or on voting rights.

No person has any special rights of control over the Company’s share capital and all issued shares are fully paid.

The Company’s Articles of Association may only be amended by a special resolution at a general meeting of the shareholders. Powers relating to the issuing and buy back of shares are also included in the Articles and the authority to issue shares is renewed by shareholders each year at the AGM.

Convertible bonds

Convertible bonds were issued during March 2010 and are described in note 21 to the consolidated Financial Statements. Pending conversion, the convertible bonds carry no votes at meetings of the Company. Ordinary shares in the Company issued on conversion will rank pari passu with the Company’s existing issued share capital. On a change of control of the Company, bondholders have an entitlement to exercise their conversion rights.

Change of control

In relation to agreements that take effect, alter or terminate upon a change of control of the Company, details of the Group’s Reserves Based Lending facilities are set out in note 20 to the consolidated Financial Statements. There are, in addition, a number of other agreements so affected, such as commercial contracts, property lease arrangements and employee share plans, none of which is considered to be significant in terms of its likely impact on the business of the Group as a whole.

Significant shareholders

At 31 December 2012 the significant interests in the voting rights of the Company’s issued ordinary shares as notified in accordance with Chapter 5 of the Disclosure and Transparency Rules were as follows:

|

|

Voting rights attaching to issued ordinary shares |

Percentage of total voting rights |

Nature of holding |

| RS Investments | 34,839,3512 | 13.59 | Indirect |

| Legal & General Investment Management | 16,960,239 | 6.60 | Direct/Indirect |

| T Rowe Price Associates, Inc | 8,536,48711 | 5.51 | Indirect |

| BlackRock | 12,982,303 | 5.05 | Direct |

| Floriline SA | 6,844,54413 | 4.42 | Direct |

1. Notification received prior to the Company’s Rights Issue in May 2012

2. Holding subsequently increased to 14.03% (see table below)

3. Holding subsequently reduced to 2.66% (see table below)

The significant interests in the voting rights of the Company’s issued ordinary shares shown above, as notified in accordance with Chapter 5 of the Disclosure and Transparency Rules, were unchanged between 1 January 2013 and 13 March 2013, being the latest practicable date prior to the publication of this Annual Report, with the exception of the following:

| Voting rights attaching to issued ordinary shares |

Percentage of total voting rights |

Nature of holding | |

| RS Investments | 36,050,063 | 14.03 | Indirect |

| Floriline SA | 6,829,972 | 2.66 | Direct |

Employees

The Company has a policy of providing employees with information about the Company and actively encourages employee involvement and consultation. Emphasis is placed on keeping employees informed of activity and financial performance by way of briefings and publication to staff of all relevant information and corporate announcements.

At year-end Salamander employed 210 people compared with 212 employees at the end of 2011.

The Group has a diverse workforce comprising a mixture of local employees and expatriates. It is an equal opportunities employer and gives every consideration to applications for employment by disabled persons where the requirements of the job may be adequately filled by a disabled person. Where existing employees become disabled, it is the Company’s policy wherever practicable to provide continuing employment under similar terms and conditions and to provide training, career development and promotion wherever appropriate.

Business conduct

The Code of Business Conduct sets out the way the Group works and comprises its vision and values. The Code of Business Conduct is supported by the Group’s policies, standards, procedures and processes. The values, set out in the Code of Business Conduct, can be viewed in full on the Group’s website at www.salamander-energy.com. These values are supported by policies which define how responsibilities will be carried out and the rules under which the Group operates. The Group’s policies are approved by the Board and the assurance of Group performance is provided by a combination of effective management processes and embedded risk and compliance activities. Independent assurance is provided both by internal reviews and independent external advisers. The Group also requires its suppliers, contractors and agents to adhere to its Code of Business Conduct and to adopt similar ethical standards.

During 2011, as part of the regular review of Group policies in consultation with representatives from the main businesses, but also in response to the coming into force of the UK Bribery Act, proposals were made for the further amendment of Group policies and procedures. The revised Group policies and procedures were subsequently published as an enhanced, integrated ethics, compliance and anti-fraud programme to maintain the Group’s high ethical standards. These included a detailed programme to combat fraud and corruption and clear policy statements emphasising the Company’s zero tolerance of any form of fraud, bribery or corruption. These policies and procedures continued in force, and were supplemented, during 2012; towards the end of the year an annual anti-bribery and corruption risk assessment was undertaken throughout the business.

During 2012, employees received briefings and training on the Code of Business Conduct and expected standards of behaviour. All employees have undertaken a bespoke online training programme to deal with fraud and corruption risks and received face-to-face briefings as required in each office. The training and briefings will be repeated in 2013 and annually thereafter as part of an ongoing Group compliance programme.

As part of the Company’s compliance programme, a confidential reporting system was introduced during 2010 for reporting any concerns about the conduct of our business. The system also includes an external reporting telephone helpline. All reports that are registered will be investigated and appropriate action taken. Any concerns raised, and opportunities for improvement, will be discussed by the Audit Committee as part of its regular review of business risks.

Annual General Meeting

The Company’s seventh Annual General Meeting as a listed public company will be held at 2pm on Thursday 23 May 2013 at the Institute of Directors, 116 Pall Mall, London SW1Y 5ED. The notice of meeting and an explanatory circular to shareholders setting out the AGM business accompanies this Annual Report.

Principal risks and uncertainties

The Board has established a process for identifying, evaluating and managing the significant risks the Group faces which are set out in the Risk Management section of this report.

Payment policy

The Group’s policy in respect of its vendors is to agree and establish terms of payment when contracting for the goods or services and to abide by those payment terms. The Company is the holding company of the Group and has no trade creditors. Further details can be found in note 24 to the consolidated Financial Statements.

Charitable and political donations

During the year the Group made no political donations (2011: nil). Charitable donations made by the Group amounted to $112,000 (2011: $11,300).

Auditors

Each person who is a Director at the date of approval of this Annual Report confirms that as far as each Director is aware, there is no relevant audit information of which the Company’s Auditors are unaware. In addition, each Director has taken all the steps that he or she ought to have taken as a Director in order to make himself or herself aware of any relevant audit information and to establish that the Company’s Auditors are aware of that information. This confirmation is given and should be interpreted in accordance with the provisions of Section 418 of the Companies Act 2006.

Deloitte LLP were first appointed as Auditors to the Company in September 2005 and have expressed their willingness to continue as Auditors. A resolution to reappoint Deloitte LLP as the Group’s Auditors will be proposed at the forthcoming AGM.

Going concern

The Group has significant expenditure commitments on its exploration and development portfolio within the next twelve months. As highlighted in note 20 and 21 to the consolidated Financial Statements, the Group meets these investment requirements through a $350 million senior reserves based lending facility, a $50 million bridge facility and a $100 million convertible bond, the principal terms of which are described in note 20 and 21 to the consolidated Financial Statements.

In order to ensure it remains within the terms of these loan facilities, the Group regularly produces cash flow statements and forecasts; and sensitivities are run for different scenarios including, but not limited to, changes in commodity prices, different production rates from the Group’s producing assets and delays to development projects. The commodity (primarily oil price) risk also affects the availability under the reserves based lending facility, but is partly managed by a 2013 hedging programme. To optimise the development of the portfolio, or in the event there are unexpected adverse changes to the Group’s cash flows, the Directors are confident that the Group could manage its financial affairs, including the securing of additional capacity under its reserves based lending facility, portfolio management, share placings and deferring of non-essential capital expenditure, so as to ensure that sufficient funding remains available for the next twelve months.

Accordingly, notwithstanding the above uncertainties, the Directors believe that the Group’s forecasts and projections, taking account of reasonably possible changes in economic assumptions, show that the Group will be able to meet all its contractual commitments and to operate within the level of its current lending facilities for the foreseeable future, being twelve months from the date of this report.

After making enquiries, the Directors have a reasonable expectation that the Company and the Group have adequate resources to continue in operational existence for the foreseeable future. Accordingly, they continue to adopt the going concern basis in preparing the Annual Report and accounts.

Approved by the Board

Charles Morgan

Company Secretary

13 March 2013

Chairman’s introduction

The Board’s role is to provide Salamander stakeholders with leadership and direction for the development and execution of the Company’s strategy, along with being collectively accountable for the long term success and achievements of the business. Attaining good governance is linked with organisational culture and by ensuring the risks and rewards of doing business are properly balanced and managed, a responsible business is created. At Salamander, we are 100% committed to all principles of good governance and ethical behaviour and we believe that this is reflected in the ways in which we manage our business and conduct our operations.

Aims and objectives

Salamander strives to apply best industry practice in all of its activities. The Board, management and staff of Salamander are committed to applying the highest standards of business ethics, corporate governance and health, safety and environmental control. To this end, the Group has put in place policies and procedures within which it conducts its activities along with working practices and a business culture that ensures openness and full accountability.

Compliance with the Financial Reporting Council’s UK Corporate Governance Code

The principal governance rules that apply to companies with a premium listing of equity shares on the London Stock Exchange are contained in the UK Corporate Governance Code adopted by the Financial Reporting Council (‘FRC’) in June 2010 and available publicly from www.frc.org.uk (the ‘Code’). The Board confirms that the Company has applied the principles of the Code as described in this report and complied with its provisions throughout the financial year ended 31 December 2012.

In September 2012, the FRC published a new edition of the Code which applies to accounting periods beginning on or after 1 October 2012. The Board has reviewed the new edition of the Code and will report on compliance with the principles set out therein in its Annual Report for the year ending 31 December 2013.

The Board of Directors

On 31 December 2012, the Board comprised the Non-executive Chairman, the Chief Executive Officer, the Chief Financial Officer, the Chief Operating Officer and five Independent Non-executive Directors.

Dr Carol Bell was appointed as a Non-executive Director of the Company on 25 January 2012. Mr James Coleman resigned as a Non-executive Director of the Company on 22 June 2012.

All of the Executive Directors have extensive upstream oil and gas experience. The majority of the Non-executive Directors have held senior appointments in oil and gas companies and, together, the Non-executive Directors bring a broad range of business and commercial experience to the Board. The membership and brief biographies of the Board Members are set out in the Board of Directors and Advisers section. These demonstrate a wealth of experience and sufficient calibre to bring independent judgement on issues of strategy, performance, resources and standards of conduct, which are fundamental to the continuing success of the Group. The Board structure ensures that no individual or group dominates the decision-making process.

The role of the Board is clearly defined. The Board is accountable to shareholders for the creation and delivery of strong, sustainable financial performance and long term shareholder value. To achieve this, the Board directs and monitors the Group’s affairs within a framework of controls which enable risk to be assessed and managed effectively. It sets the Group’s strategic aims, ensuring that the necessary resources are in place to achieve those aims, and reviews management and financial performance. The Board also has responsibility for setting the Group’s core values and standards of business conduct and for ensuring that these, together with the Group’s obligations to its stakeholders, are widely understood throughout the Group.

There is a clear separation between the roles of the Chairman and Chief Executive Officer. The Chairman’s key responsibilities are the effective running of the Board, ensuring that the Board plays a full and constructive part in the development and determination of the Group’s strategy, and acting as guardian of the Board’s decision-making process. The Chairman’s other significant commitment is as Chairman of Vostok Energy Limited. The Board believes that the Chairman’s obligations are unaffected by this appointment. The key responsibilities of the Chief Executive Officer are managing the Group’s business, proposing and developing the Group’s strategy and overall commercial objectives in consultation with the Board and, as leader of the executive team, implementing the decisions of the Board and its Committees. In addition, the Chief Executive Officer is responsible for maintaining regular dialogue with major shareholders as part of the Company’s overall investor relations programme.

The Group maintains Directors’ and officers’ liability insurance cover, the level of which is reviewed annually.

All Directors and Board Committee members have access to independent professional advice, at the Company’s expense, as and when required.

Non-executive Directors

Non-executive Directors are appointed for an initial term of three years. They may serve a further three-year term subject to satisfactory performance; thereafter, their appointments are renewed on an annual basis, again, subject to satisfactory performance. The letters of appointment of each Non-executive Director are available for inspection. The Senior Independent Non-executive Director is Struan Robertson. In this role he is available to shareholders who have concerns that cannot be resolved through discussion with the Chief Executive or Chairman.

Charles Jamieson, Robert Cathery, John Crowle and Struan Robertson have served two three-year terms and their appointments have been renewed for a further one year in accordance with the above policy. The Board and the Nominations Committee have taken into account the need for progressive refreshing of the Board and believe that it is in the interests of the Company to retain their services for this further period due to the knowledge and experience they bring to the Board.

Governance framework

The Board meets at least quarterly during the year and on an ad hoc basis as required. The attendance record of each Director is shown in the table below.

| Director | Attended | Possible |

| Charles Jamieson | 6 | 6 |

| James Menzies | 6 | 6 |

| Carol Bell (appointed on 25 January 2012) | 4 | 5 |

| Mike Buck | 6 | 6 |

| Robert Cathery | 5 | 6 |

| James Coleman (resigned on 22 June 2012) | 2 | 3 |

| Jonathan Copus | 6 | 6 |

| John Crowle | 6 | 6 |

| Michael Pavia | 6 | 6 |

| Struan Robertson | 6 | 6 |

In addition to the formal meetings of the Board, the Chairman and Executive Directors maintain frequent contact with the other Directors to discuss any issues of concern they may have relating to the Group or as regards their area of responsibility and to keep them fully briefed on ongoing matters relating to the Group’s operations.

Directors have access to a regular supply of financial, operational and strategic information, as well as to the Company Secretary on corporate governance matters, to assist them in the discharge of their duties. Such information is provided as part of the normal monthly management reporting cycle undertaken by senior management. Board papers are generally circulated seven days in advance of Board meetings and each formal Board meeting includes a review of operational performance of key assets together with reporting on financial performance.

In late 2011 the Board established a Technical Assurance Committee (‘TAC’), comprised of external experts, that is charged with reviewing the geological and geophysical work being done by the Company and reporting back to the Board on the quality of this work. The TAC meets twice or thrice yearly in the Company’s operating offices and provides expert review and advice to Salamander’s technical professionals and technical assurance to the Board via the TAC Chairman.

A formal schedule of matters reserved for Board approval is in place. In addition to those formal matters required by the Companies Act to be set before a board of directors, the matters reserved include: the Group’s overall strategy and policy, approval of annual and interim results, business plans, material acquisitions and disposals, material contracts and major capital expenditure projects and budgets.

Subject to those reserved matters, the Board delegates authority for the management of the business primarily to the Chief Executive and a senior executive committee. Certain other matters are delegated to the Audit, Remuneration and Nominations Committees. Further details of these committees are set out below and, in the case of the Remuneration Committee, are also contained in the Remuneration Report section. Copies of each committee’s terms of reference are available on the Company’s website at www.salamander-energy.com.

Board performance and evaluation

Annual performance appraisal of the Board, its Committees, individual Directors and the Chairman was carried out in a series of meetings during October 2012. As part of this process, the Non-executive Directors, led by the Senior Independent Director, met without the Chairman to evaluate his performance in leading the Board and ensuring that the Board’s business is conducted in an effective manner.

Two areas of focus emerging from the October review sessions were succession planning for the Non-executive Directors and Board composition. Accordingly, in December 2012, Socia Limited was commissioned to undertake an external evaluation of the Board, its members and processes, focussing in particular on succession planning, Board composition and the company secretarial role. The external facilitator conducted interviews with each Board member and the Group General Counsel and Company Secretary, asking each to assess the Board’s performance in five areas. The resulting report, including recommendations for action, was presented to the Board. The Board is currently in the process of formulating a response plan based on the recommendations. The Chairman and Company Secretary will monitor progress over the year and the findings will play a key role in the structure and focus of the next evaluation.

Socia Limited does not provide any other services to the Company.

Induction, training and development

The Company Secretary, in consultation with the Chairman and Chief Executive, provides an induction process for each new Director tailored to their individual knowledge and experience.

The Company provides training to Directors where required. Training can include attendance at seminars, briefings by advisers and internal briefings.

During 2012, the Company Secretary provided updates to the Board on corporate governance matters and detailed presentations were received by the Board from key members of the senior management team in each of Salamander’s business units in Indonesia and Thailand.

Directors’ conflicts

Where the Articles of Association of a company contain a provision to that effect, the Companies Act 2006 allows directors of public companies to consider, and if thought fit, authorise situations where a Director has an interest that conflicts, or may potentially conflict, with the interests of the Company. The Articles of Association of the Company contain a provision to this effect. Directors of the Company who have an interest in matters under discussion at a Board meeting must declare that interest and abstain from voting. Only Directors who have no interest in the matter being considered are able to approve a conflict of interest and, in taking the decision the Directors must act in a way they consider, in good faith, would be most likely to promote the Company’s success. The Directors are able to impose limits or conditions when giving authorisation if they think this is appropriate. During the year procedures, based upon the GC100 guidance, were in place to review any conflicts of interest.

The procedures for the declaration and authorisation of conflicts have been followed and tested and the Board considers that such procedures continue to operate effectively.

Annual re-election of Directors

All Directors appointed by the Board are required by the Company’s Articles of Association to be subject to re-election by shareholders at the next AGM after their appointment. Subsequently, the Articles of Association of the Company provide that Directors are subject to re-election by shareholders at least every three years. However, the Company is supportive of the recommendation from the Code that all Directors annually stand for re-election. Accordingly, and as at the 2010, 2011 and 2012 AGM, all Board members will offer themselves for re-election at the 2013 AGM.

A resolution will be put forward to shareholders at the 2013 AGM to approve changes to the Company’s Articles of Association. These changes will include, amongst other proposed changes, a requirement for Directors to be subject to annual election by shareholders.

Prior to such re-elections, the Chairman and the Nominations Committee will review each Director’s performance to ensure they continue to be effective and demonstrate commitment to the role.

Risk management and internal control

The Board has established a process for identifying, evaluating and managing the significant risks the Group faces. Additionally, the Board is responsible for the Group’s system of internal control and for reviewing its effectiveness. Such a system is designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable and not absolute assurance against material mis-statement or loss.

The Board formally reviews the Group’s risk register twice a year and the Executive Directors monitor events on an ongoing basis and report to the Audit Committee any material risks or failure in controls.

The Board regularly reviews the effectiveness of the Group’s system of internal control which has been in place throughout 2012 and up to the date of approval of this Annual Report. As part of its review of internal controls during the year, the Group undertook various audits and reviews, implemented relevant training programmes and also conducted a review of its policies and procedures. The Board’s monitoring covers control matters, including financial, operational and compliance controls and risk management. It is based principally on reviewing reports from management to consider whether significant risks are identified, evaluated, managed and controlled and whether any significant weaknesses are promptly remedied and indicate a need for more extensive monitoring. The Audit Committee assists the Board in discharging its review responsibilities. A summary of the key risks facing the Group and mitigating actions are described in the Risk Management section of this report.

Following its review of the system of internal control, including the review of the Group’s policies and procedures noted above, the Board confirms that necessary actions have been taken or are being taken to remedy any significant failings or weaknesses identified from that review.

The Audit Committee has established an internal audit function. During 2012, audits and reviews were undertaken on the instruction of the Audit Committee. The findings of those audits and reviews were reported to the Audit Committee and action plans implemented.

Shareholder relations

Communication with shareholders is given high priority and there is regular dialogue with institutional investors, as well as general presentations to analysts at the time of the release of the annual and half-year results. The Company also hosted a Capital Markets Day on 28 June 2012. Management completed over 230 meetings with institutions during 2012. The Board receives regular investor relations reports covering key investor meetings and activities, as well as shareholder and investor feedback. The Group publishes its periodic results and other stock market announcements on the Investor Relations section of the Company’s website, www.salamander-energy.com and regular news updates in relation to the Group, including the status of exploration and development programmes, are also included on the website. Shareholders and other interested parties can subscribe to receive these news updates by e-mail by registering online on the website.

The Board also uses the Annual General Meeting to communicate with private and institutional investors and welcomes their participation. The Board aims to ensure that the entire Board is available at the AGM to answer questions and explain details of the resolutions proposed at the AGM. Notice of the AGM and related papers are sent to shareholders at least 20 clear business days before the meeting in accordance with the Code and Companies Act.

Remuneration Committee

The primary duty of the Remuneration Committee is to determine the framework or broad policy for the remuneration of the Company’s Chairman, the Executive Directors, the Company Secretary and other members of senior management. Further details of the work of the Remuneration Committee, its responsibilities, membership and meeting attendance are set out in the Remuneration Report.

Nominations Committee

The members of the Nominations Committee are Struan Robertson (Chairman), Charles Jamieson and Robert Cathery. The attendance record of each member of the Committee is shown in the table below.

| Director | Attended | Possible |

| Struan Robertson | 2 | 2 |

| Robert Cathery | 2 | 2 |

| Charles Jamieson | 2 | 2 |

The Nominations Committee’s terms of reference, which are included on the Company’s website, www.salamander-energy.com, are to review regularly the structure, size and composition (including the skills, knowledge and experience) required of the Board compared to its current position and make recommendations to the Board with regard to any changes. The Nominations Committee also considers future considerations of the composition of the Board, taking into account the challenges and opportunities facing the Group, and what skills and expertise are needed on the Board.

Following a decision of the Board that the appointment of a new Director is appropriate, the duty of the Committee is to present for consideration suitably qualified candidates. In making such recommendations, the Committee evaluates the balance of skills, knowledge and experience on the Board and develops a description of the role and required capabilities. Candidates are then identified for interview. The Committee also makes recommendations to the Board regarding the re-election and/or reappointment of any Director. Similar selection processes would apply for the appointment of a Chairman. Succession plans for key management roles, including the Executive Directors, are reviewed on an ongoing basis.

The Committee met two times during the year and its activities included a review of the Company’s succession plans and discussion in respect of the ongoing structure and capability of the Board. As a result of this review, an external facilitator was commissioned to undertake an external evaluation of the Board, its members and processes, further details of which are in the Board Performance and Evaluation section of this report.

The appointment of Dr Carol Bell in January 2012 was made following a search led by the Senior Independent Non-executive Director on behalf of the Nominations Committee, in conjunction with external consultants, whose brief included but was not limited to the need for diversity in the boardroom. In recommending Carol’s appointment, the Committee noted that Carol had wide commercial experience gained through a successful career in oil and gas, and banking, which would be an asset to the Board.

The Committee keeps itself updated on key developments relevant to the Company, including most recently, on the subject of diversity in the boardroom. The Board believes in creating throughout the Company a culture free from discrimination in any form. The Committee believes in providing mentoring for women in senior roles to help them maximise their careers with the Company.

The Board and Committee does not currently set specific representation targets for women at Board level; however, the benefits of diversity, including gender diversity, are an active consideration when changes to the Board’s composition are contemplated, within the overriding objective of ensuring that the Board has the appropriate balance of skills, experience and independence.

Further to the amendments to the UK Governance Code introduced in September 2012, a focus of the Committee during 2013 will be the formulation of a policy on diversity.

Audit Committee

Membership

The members of the Audit Committee are Michael Pavia (Chairman), Carol Bell, John Crowle and Struan Robertson. Other Board members may also be invited to attend committee meetings. Michael Pavia is considered to have recent and relevant financial experience.

Attendance

The attendance record of each member of the Committee is shown in the table below.

| Director | Attended | Possible |

| Michael Pavia | 4 | 4 |

| Carol Bell (appointed to the Committee on 28 August 2012) | 2 | 2 |

| John Crowle | 4 | 4 |

| Struan Robertson | 4 | 4 |

Meetings are held at least three times a year. The Chief Financial Officer and other members of the Board are invited to attend meetings where appropriate and the Group’s Auditors are regularly invited to attend meetings, including once at the planning stage before the audit and once during the year-end audit and half-year review at the reporting stage. At least once a year the Audit Committee will also meet the Group’s external auditors without management being present.

The terms of reference of the Audit Committee are included on the Company’s website, www.salamander-energy.com.

Responsibilities

The work of the Audit Committee in respect of the financial year has included:

- consideration of matters relating to the appointment of the Group’s Auditors;

- reviewing the independence, objectivity and effectiveness of the Group’s Auditors;

- reviewing the integrity of the Group’s annual and half-year reports, interim management statements and any other formal announcement relating to its financial performance;

- reviewing the effectiveness of the Group’s system of internal control and compliance procedures;

- reviewing the Group’s arrangements for its employees to raise concerns, in confidence, about possible wrongdoing in financial reporting or other matters; and

- reporting to the Board on how the Committee has discharged its responsibilities.

In fulfilling its responsibility of monitoring the integrity of financial reports to shareholders, the Audit Committee has reviewed accounting principles, policies and practices adopted in the preparation of public financial information and has examined documentation relating to the Annual Report and Half-year report. The clarity of disclosures included in the financial statements was reviewed by the Audit Committee, as was the basis for significant estimates and judgements. In assessing the accounting treatment of major transactions open to different approaches, the Committee considered written reports by management and the external auditors. The Committee’s recommendations were submitted to the Board for approval.

The Committee has responsibility for the implementation of internal controls and receives an update at each meeting as to the status of the development of internal controls. In addition, audits and reviews are undertaken during the year on specific areas of internal control, at the direction of the Audit Committee, and the outcome and findings of those audits and reviews, along with recommendations, are reported to the Audit Committee to consider and to implement appropriate responses.

The Committee also reviewed the independence and effectiveness of the external auditors, accepting that their independence had been maintained throughout the audit process for the financial year.

The Committee considers that at this stage it is more efficient to use a single audit firm to provide certain non-audit services for transactions and tax matters. However, to regulate the position, the Committee has established a policy on the provision of non-audit services by the external auditor, further details of which are set out below.

Provision of non-audit services and auditor independence

The Company has a formal policy on the provision of non-audit services. In compiling that policy, which sets out the external auditor’s permitted and prohibited non-audit services and a fee threshold requiring prior approval by the Audit Committee for any new engagement, reference was made to Ethical Standard 5 of the Auditing Practices Board.

In accordance with the Company’s policy on the provision of non-audit services, the Board sought and received approval from the Audit Committee for the material non-audit services provided by the Company’s external auditors in respect of the provision of reporting accounting services in relation to the Company’s Rights Issue that took place in the second Quarter of 2012. As part of the process for ensuring auditor independence, the Board received a letter from Deloitte LLP confirming that they were compliant with APB Ethical Standard for Reporting Accountants and that, in their professional judgement they were independent of the Company and their objectivity was not compromised.

The Company appointed its Auditors as reporting accountants to its $212 million Rights Issue of May 2012 having regard to cost and the limited time available to complete the transaction.

Details of non-audit fees incurred during 2011 and 2012 are set out in note 5 of the consolidated 2012 Financial Statements.

Auditor appointment

The Board is satisfied that Deloitte LLP has adequate policies and safeguards in place to ensure that auditor objectivity and independence are maintained. The external auditors report to the Audit Committee annually on their independence from the Company. In accordance with professional standards, the partner responsible for the audit is changed every five years, and last changed in 2010.

The current audit firm was appointed in 2005 and the audit has not been put out to tender since that date. The Audit Committee has considered whether the audit should go out to tender but has taken the view so far that partner rotation at both the Group and operating business level has been sufficient to maintain the necessary independence. No restrictions are placed on the choice of external auditors.

In line with its terms of reference, the Audit Committee undertakes a thorough assessment of the quality, effectiveness, value and independence of the external audit provided by Deloitte LLP on an annual basis. This is carried out by seeking the views and feedback of the Board, together with those of the Group.

Following the most recent review, the Audit Committee has determined to recommend to the Board the re-appointment of Deloitte LLP at the 2013 AGM.

This report has been prepared in accordance with Schedule 8 to the Accounting Regulations under the Companies Act 2006. The report also meets the relevant requirements of the Listing Rules of the Financial Services Authority and describes how the Board has applied the principles relating to Directors’ remuneration in the UK Corporate Governance Code. As required by the Act, a resolution to approve the report will be proposed at the Annual General Meeting of the Company at which the financial statements will be approved.

The Act requires the auditor to report to the Company’s members on certain parts of the Directors’ Remuneration Report and to state whether in their opinion those parts of the report have been properly prepared in accordance with the Accounting Regulations. The report has therefore been divided into separate sections for audited and unaudited information.

Unaudited information

Remuneration Committee

The Company has established a Remuneration Committee which is constituted in accordance with the recommendations of the UK Corporate Governance Code.

The Committee is formally constituted with written terms of reference and its main responsibilities are detailed below. The terms of reference of the Remuneration Committee are available on the Company’s website, www.salamander-energy.com.

Membership

The members of the Remuneration Committee are currently Robert Cathery (Chairman), Struan Robertson and John Crowle. The Committee’s primary duty is to determine and agree with the Board the framework or broad policy for the remuneration of the Group’s Chief Executive, the Chairman, the Executive Directors, the Company Secretary and such other members of the senior management as it is designated to consider. The remuneration of the Non-executive Directors is a matter for the Chairman and the executive members of the Board.

The Chief Executive is invited to attend meetings of the Committee but does not take part in the decision making of the Committee.

Attendance

Details of each Committee member’s attendance at Committee meetings held during the year is set out in the table below.

| Director | Attended | Possible |

| Robert Cathery | 3 | 3 |

| John Crowle | 2 | 3 |

| Struan Robertson | 3 | 3 |

Responsibilities

The main responsibilities of the Committee are to:

- set and monitor performance criteria for any bonus arrangements operated by the Company and its Group ensuring that they represent achievable and motivating rewards for appropriate levels of performance and, where appropriate, are justifiable taking into account the Company’s and Group’s overall performance and the corresponding return on shareholders’ investment in the same period;

- recommend to the Board the policy for and scope of pension arrangements for the Executive Directors and other senior management taking into account the future liabilities of any recommendation and to detail precisely which elements of the remuneration packages are pensionable;

- review and approve the Company’s share option and share award schemes (including any long term co-investment plans), approve proposed option grants or share awards to Directors or senior management, and to set or recommend performance criteria for share awards; and

- within the terms of the agreed policy, determine the total individual remuneration package for the Company’s Chairman, Executive Directors, Company Secretary and other senior management including, where appropriate, bonuses, incentive payments and share options or other share awards.

The Committee members have no personal or financial interest other than as shareholders in matters to be decided and no day-to-day involvement in running the business.

External consultants

The Committee has access to external consultancy services on remuneration and sector issues. Hewitt New Bridge Street Consultants were employed to assist, as required, only with matters relating to the Company’s Performance Share Plan. Hewitt New Bridge Street Consultants have no connection with the Company.

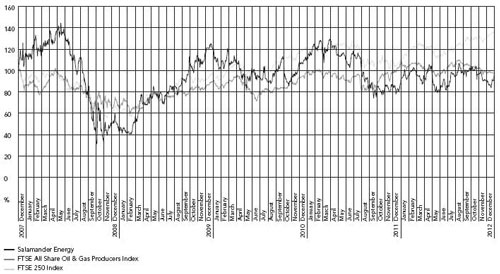

Historical comparator performance chart

The chart below shows the Company’s Total Shareholder Return over a five year period from 31 December 2007 to 31 December 2012 compared to that of the FTSE All Share Oil & Gas Producers Index and the FTSE250 Index over the same period, which the Committee considers are the closest comparable indices.

The preceding chart looks at the value of £100 invested in the Company’s issued ordinary share capital compared with the values of £100 invested in the FTSE All Share Oil & Gas Producers Index and the FTSE250. It is assumed that any dividends are re-invested.

Executive Directors’ remuneration

The Group’s remuneration policy is to provide remuneration packages which ensure that Directors and senior managers are fairly and responsibly rewarded for their contributions. The aim is to provide remuneration packages which are sufficiently competitive to attract, retain and motivate individuals of the quality required to achieve the Group’s objectives and thereby enhance shareholder value. The Committee takes account of the level of remuneration paid to Executive Directors and senior managers of comparable public companies and best practice standards. It is the intention that this policy will continue to apply for 2013 and subsequent years subject to ongoing review as appropriate.

A significant proportion of Salamander’s total remuneration package is variable with an emphasis on long term incentives in the form of share-based payments linked to company performance. This ensures that the interests of Directors are aligned closely with those of shareholders.

The main details of the Executive Directors’ Service Agreements relating to base salary, annual bonus, share plan awards, pensions and other benefits for 2012 are as set out below.

Service Agreements

The Service Agreements for the Executive Directors are for no fixed term and may in normal circumstances be terminated by either party on giving six months’ notice. The Company reserves the right and discretion to pay the Executive Director in lieu of notice. If the Company terminates the employment of an Executive Director by exercising its right to pay in lieu of notice, the Company is required to make a payment equal to the aggregate of basic salary and the cost to the Company of providing other contractual benefits (which excludes bonus) for the unexpired portion of the duration of any entitlement to notice.

If, within 12 months of a change of control, the Company terminates the employment of an Executive Director in breach of the terms of his Service Agreement in circumstances where the Company is not entitled to terminate the Executive Director’s employment, the Executive Director will be entitled to payment of a fixed sum equal to six months’ base salary (not including accrued bonus). In return for the payment of such a fixed sum, the Executive Director agrees to waive, release and discharge any entitlement to further or additional compensation of any kind whatsoever.

| Date of contract | Notice period | |

| James Menzies | 29/11/06 | Six months |

| Mike Buck | 29/11/06 | Six months |

| Jonathan Copus | 31/10/11 | Six months |

Salary

The annual base salaries of the Executive Directors for the year to 31 December 2012 were as follows:

| Salary £’s | |

| James Menzies | 410,970 |

| Mike Buck | 302,820 |

| Jonathan Copus | 290,000 |

The salary of each Executive Director is subject to regular review by the Remuneration Committee and such a review took place in December 2012. During the review, a 3.4% salary increase for James Menzies and Jonathan Copus, and a 3.0% salary increase for Mike Buck, were agreed by the Remuneration Committee for the year to 31 December 2013.

When determining the salary of the Executive Directors the Committee takes into consideration:

- the levels of base salary for similar positions with comparable status, responsibility and skills, in organisations of broadly similar size and complexity, in particular the levels of base salary at those comparable companies within the FTSE Oil and Gas Producers sector and the Comparator Group;

- the performance of the individual Executive Director;

- the individual Executive Director’s experience and responsibilities; and

- pay and conditions throughout the Company.

Bonus

Each of the Executive Directors is eligible for a non-pensionable discretionary annual bonus up to a maximum of 100% of their base salary. The bonus may only be payable to the extent that individual and corporate performance targets set by the Remuneration Committee are achieved in the relevant year.

Executive bonus levels are assessed on the level of the Company’s performance against financial, operational and strategic targets, subject to the Committee’s discretion based on a broader assessment of overall company performance. These may include, but are not limited to:

- share price performance;

- operational performance;

- HSE performance; and

- financial performance.

Considering the above, the Remuneration Committee assessed that an award of 40% of the maximum bonus potential was appropriate for each of the Executive Directors for the year ended 31 December 2012 when judging by the achievements of the Executive team against the above priorities and when looking at a broader picture of the Company’s performance over the period.

Targets for the annual bonus plan are reviewed and agreed by the Remuneration Committee each year to ensure that they are appropriate to the current position of the Company. The Committee is in no doubt that in the current economic environment, achieving substantial progress in these priority areas will continue to be extremely challenging. Non-executive Directors do not participate in any bonus arrangements.

The Company does not disclose specific targets for reasons of commercial sensitivity.

Pay and conditions across the Group

Consideration has also been given to general pay and employment conditions across the Group. The Group operates in a number of different countries and has many employees who perform a diverse range of jobs. Therefore, although it is difficult to take into account pay and employment conditions across the Group specifically when setting the remuneration of the Executive Directors:

- all employees, including the Directors, are paid by reference to the market rate;

- consistently high performance is rewarded through a number of performance‐related bonus schemes across the Group;

- the Group offers internal promotion opportunities;

- the Group offers employment conditions which are commensurate with a UK-listed company including high standards of health and safety and equal opportunity policies;

- the Group offers a range of benefits depending on employee location including pension, flexible benefits, paid annual leave and healthcare insurance; and

- in accordance with the Company’s belief that share plans are important to align the interests of employees and shareholders, the Company offers the following employee share plans, further details of which are set out below and in note 28 to the Financial Statements:

– the Performance Share Plan, open to Executive Directors and senior management; and

– the Deferred Share Plan (as approved by the shareholders at the 2009 Annual General Meeting), open to all other employees.

The Remuneration Committee will continue to assess these and other matters, such as the prevailing market conditions, when determining levels of remuneration for Executive Directors.

Performance Share Plan

In accordance with the Company’s Performance Share Plan (‘PSP’) and at the discretion of the Remuneration Committee, all eligible employees including Executive Directors may be awarded share options in the Company, the vesting of which are subject to conditions as set out in this report (‘Awards’). The Committee supervises the operation of the PSP including the levels of Awards made to employees and Executive Directors and ensures that no individual is granted excessive levels of Awards, taking into consideration the overall quantum and structure of that individual’s compensation package.

In 2009, the Remuneration Committee decided to amend its policy of granting Awards to the whole workforce, and limited participation in the PSP to senior executives. Accordingly, as approved by the shareholders at the 2009 Annual General Meeting, a new deferred bonus scheme (‘DEP’) replaced the PSP for certain employees but not Directors, recognising that the PSP continuing to apply to all employees was not appropriate. The PSP remains the sole long term incentive arrangement for all Executive Directors.

The PSP is intended to facilitate the retention and incentivisation of senior executives within the Group, including Directors, and to align their interests with those of shareholders by enabling them to receive shares in Salamander, subject to the satisfaction of performance conditions and continued employment. The Remuneration Committee believes that the PSP provides an appropriate degree of flexibility in the way in which a share based incentive arrangement can be operated by the Group, while giving due consideration to best and market practice.

The PSP was first adopted when the Company listed on the London Stock Exchange in 2006. When it was adopted, the PSP was structured so as to provide a competitive long term incentive compared to other companies of a similar size (Salamander initially listed within the FTSE Small Cap), and with the features conforming to prevailing market practice and best practice at that time. In 2010, the Remuneration Committee reviewed the operation of the PSP in the context of Salamander as a FTSE 250 constituent and concluded that, in order to remain competitive relative to the market, changes to its operation for 2010 and future years were required, namely, an increase to the individual limit in the PSP to 200% of salary p.a. In circumstances where the Committee considers it appropriate to do so, including the recruitment or retention of an employee or Executive Director, the Committee may exceed the normal 200% limit at its discretion.

The PSP is operated as follows:

- Awards are made annually to Executive Directors worth up to 200% of salary (which is the maximum grant limit except where the Remuneration Committee deems it necessary to grant a higher award in specific circumstances). Other senior management are also granted Awards, predominantly at a lower percentage of salary; and

- the vesting of Awards is subject to a relative total shareholder return (‘TSR’) performance condition, comparing Salamander’s TSR performance to that of a selected group of other listed Oil & Gas Exploration & Production companies, measured over three years.

Awards vest on or following the third anniversary of the date of grant once the Committee has determined the extent to which the applicable performance condition (see below) has been satisfied and provided the participant remains an employee with the Group. Awards, once vested, will normally remain capable of exercise for a period of twelve months.

Awards granted to all employees, including the Executive Directors, will vest based on Salamander’s performance against an industry-specific peer group of companies drawn from the constituents of the FTSE 250, FTSE Small Cap and AIM listed companies in the Oil and Gas Producers sector with market capitalisations in excess of £100 million at or around the date of grant. The comparator groups for the 2012 and 2011 awards were:

| 2012 Awards | 2011 Awards | ||

| Afren | Ithaca Energy | Afren | Heritage Oil |

| Bankers Petroleum | JKX Oil & Gas | Aurelian Energy | Ithaca Energy |

| Bowleven | Nautical Petroleum | Bowleven | JKX Oil & Gas |

| Cairn Energy | Ophir Energy | Cairn Energy | Jubilant Energy |

| Coastal Energy | PetroCeltic International | Coastal Energy | Melrose Resources |

| EnQuest | Providence Resources | Cove Energy | Nautical Petroleum |

| Exillon Energy | Range Resources | Encore | Petroceltic |

| Faroe Petroleum | RusPetro | Enquest | Premier Oil |

| Genel Energy | SOCO International | Faroe Petroleum | San Leon |

| Geopark Holdings | Valiant Petroleum | Geopark Holdings | SOCO International |

| Gulf Keystone Petroleum | Xcite Energy | Gulf Keystone | Tullow Oil |

| Heritage Oil | Gulfsands Petroleum | Valiant Petroleum |

Awards vest as follows in relation to Salamander’s relative TSR performance over the performance period:

- if Salamander is ranked below median, none of the award will vest;

- for a ranking position of median, 30% of the award will vest;

- for a ranking position of upper quartile or better, full vesting (100% of the award) will occur; and

- for a ranking between median and upper quartile, there will be straight line vesting between 30% and 100%.

Hewitt New Bridge Street carried out a performance monitoring exercise in 2012 in respect of the Awards made on 27 March 2009 under the terms of the Salamander Performance Share Plan. Their calculations were carried out to 26 March 2012, the end of the performance period for these Awards and therefore represented final results. As noted above, these Awards were subject to a TSR performance condition relative to the 2012 comparator group over a performance period. Based on Salamander’s TSR and ranking being between median and upper quartile, the Awards vested at 77.46% of the number of Awards granted on 27 March 2009. The number of shares to be transferred on exercise of the Awards was increased by 24.1% following the rights issue in April 2012. The market price on vesting of the Awards was £1.79. Details of the Directors’ interests further to the vesting of this Award are set out in the Directors’ Report.

At 31 December 2012, a total of 5,911,544 Awards of options over ordinary shares (representing 2.30% of the Company’s issued share capital of 256,954,637 ordinary shares at the year-end) were outstanding and granted to eligible employees including the Executive Directors under the PSP.

Further information regarding Share Based Payments is included in note 28 to the consolidated Financial Statements.

Benefits

Executive Directors receive a defined pension contribution (or salary supplement in lieu of pension contributions) equal to 15% of their salary, private medical cover and life assurance of up to four times salary.

Non-executive Directors’ remuneration

The Company’s policy on Non-executive Directors’ remuneration is to set compensation at a level which is sufficiently competitive to attract, retain and motivate high quality non-executives and to be consistent with best practice standards. Non-executive Directors may not participate in the Company’s PSP or pension arrangements. Each of the Non-executive Directors is entitled to reimbursement of reasonable expenses incurred in the course of their duties and to Directors’ and officers’ liability insurance cover.

The Board reviews Non-executive Directors’ (including the Chairman’s) remuneration periodically to ensure it remains competitive. Additional fees are paid to the chairmen of the Audit, Remuneration and Nominations Committees. Save in relation to Charles Jamieson (£100,000), the fees of each Non-executive Director set out below comprise a £45,000 annual base fee and an additional annual fee of £5,000 for chairing a Board Committee. Struan Robertson also receives an additional annual fee of £10,000 for his role as Senior Independent Non-executive Director. John Crowle receives an additional annual fee of £5,000 in recognition of his responsibility for advising, as required, on technical issues and chairing the Technical Assurance Committee.

All Non-executive Directors have letters of appointment with the Company. Charles Jamieson was appointed to the Board on 9 November 2006; Struan Robertson, John Crowle and Robert Cathery were appointed to the Board on 29 November 2006; and Michael Pavia, James Coleman and Carol Bell were appointed to the Board on 9 July 2007, 8 May 2008 and 25 January 2012 respectively. James Coleman resigned as a Director on 22 June 2012. All appointments are subject to satisfactory performance and all directors annually stand for re-election at the Company’s AGM.

| Annual salary £’s | Date of contract | Notice period | |

| Charles Jamieson | 100,000 | 29/11/06 | Three months |

| Struan Robertson | 62,750 | 29/11/06 | One month |

| Michael Pavia | 52,250 | 09/07/07 | One month |

| John Crowle | 52,250 | 29/11/06 | One month |

| Robert Cathery | 52,250 | 29/11/06 | One month |

| James Coleman | 46,125 | 08/05/08 | One month |

| Carol Bell | 44,223 | 25/01/12 | One month |

Audited information

Aggregate remuneration of Directors

The total amount of Directors’ remuneration was as follows:

| 2012 £’s |

2011 £’s |

|

| Emoluments | 1,993,772 | 1,867,895 |

| Gains on exercise of share options | 638,578 | 748,881 |

| Money purchase pension contribution | 150,569 | 125,909 |

| Total aggregate remuneration | 2,782,919 | 2,742,685 |

Remuneration of Directors

The remuneration of Directors during 2012 was as follows:

| 2012 | 2011 | ||||

| Base salary £’s |

Bonus £’s |

Benefits3 £’s |

Total £’s |

Total £’s |

|

| Executive Directors | |||||

| James Menzies | 410,970 | 165,000 | 67,128 | 643,098 | 690,355 |

| Mike Buck1 | 302,820 | 125,000 | 202,232 | 630,052 | 636,947 |

| Jonathan Copus2 | 290,000 | 125,000 | 46,343 | 461,343 | 204,5122 |

| Nick Cooper | – | – | – | – | 136,990 |

| Non-executive Directors | |||||

| Charles Jamieson | 100,000 | – | – | 100,000 | 70,000 |

| Struan Robertson | 62,750 | – | – | 62,750 | 60,000 |

| Michael Pavia | 52,250 | – | – | 52,250 | 50,000 |

| John Crowle | 52,250 | – | – | 52,250 | 50,000 |

| Robert Cathery | 52,250 | – | – | 52,250 | 50,000 |

| James Coleman | 46,125 | – | – | 46,125 | 45,000 |

| Carol Bell | 44,223 | – | – | 44,223 | – |

| Total | 1,413,638 | 415,000 | 315,703 | 2,144,341 | 1,993,804 |

- In line with the Group’s policy, expatriate employees are paid a net salary by the Group in their host country based on their base salary and other factors associated with living abroad. The salary and benefits reported above for Mike Buck include his net expatriate salary grossed-up for income tax payable in his host country, and other expatriate benefits.

- Jonathan Copus received a bonus of £155,000 during 2011, being a signing on bonus of £30,000 and a performance bonus of £125,000.

- Included in the benefits above are pension contributions of £151,000 (2011: £126,000).

Share Awards held at 31 December 2012, including awards of shares made during the year, to Executive Directors under the PSP are given in the table below:

| Award date | At 1 Jan 2012 Number |

Awards granted Number |

Awards exercised Number |

Awards lapsed Number |

At 31 Dec 2012 Number |

Earliest exercise Date |

Latest exercise Date |

James Menzies |

|||||||

| 27/03/091 | 303,035 | – | 234,7312 | 68,3044 | – | 27/03/12 | 27/03/13 |

| 11/05/101 | 400,153 | – | – | – | 400,153 | 11/05/13 | 11/05/14 |

| 04/04/111 | 317,573 | – | – | – | 317,573 | 04/04/14 | 04/04/15 |

| 18/05/12 | 505,498 | – | – | 505,498 | 18/05/15 | 18/05/16 | |

| 1,020,761 | 505,498 | 234,731 | 68,304 | 1,223,224 | |||

Mike Buck |

|||||||

| 27/03/091 | 228,893 | – | 177,3003 | 51,5934 | – | 27/03/12 | 27/03/13 |

| 11/05/101 | 294,849 | – | – | – | 294,849 | 11/05/13 | 11/05/14 |

| 04/04/111 | 234,000 | – | – | – | 234,000 | 04/04/14 | 04/04/15 |

| 18/05/12 | – | 372,472 | – | – | 372,472 | 18/05/15 | 18/05/16 |

| 757,742 | 372,472 | 177,300 | 51,593 | 901,321 | |||

Jonathan Copus |

|||||||

| 31/10/111 | 202,844 | – | – | – | 202,844 | 31/10/14 | 31/10/15 |

| 18/05/12 | - | 356,704 | – | – | 356,704 | 18/05/15 | 18/05/16 |

| 202,844 | 356,704 | – | – | 559,548 | |||

- The number of shares subject to the Share Award was adjusted by increasing the original Share Award by 24.1% to reflect the rights issue which took place on 17 May 2012. The adjusted numbers are quoted in the table above.

- The share price on the date of exercise was £1.62.

- The share price on the date of exercise was £1.69.

- The Awards lapsed represent the proportion of the Award that remained unvested at the end of the performance period (see note (c) below)

Notes

- Awards are in the form of a nominal cost option and no payment is required for the grant of an Award. However, participants who are granted nominal cost options under the PSP are required to pay the Company the nominal value of £0.10 for each share issued upon the exercise of the option;

- Performance conditions are based on the Company’s total shareholder return performance relative to a comparator group of companies over a 3-year performance period. No Awards vest if performance is ranked below median, 30% of the Awards vest for a ranking position of median. 100% of Awards vest if performance is at or above the upper quartile. For a ranking between the median and upper quartile, there is a straight line vesting between 30% and 100%.

- During 2012 Hewitt New Bridge Street carried out a performance monitoring exercise in respect of the awards made on 27 March 2009 under the terms of the Salamander Energy Performance Share Plan. Accordingly, Awards vested at 77.46% of the number of Awards granted on 27 March 2009. The market price on vesting of the Award was £1.79.

- The highest and lowest closing prices of the Company’s shares during the year were £2.129 and £1.575 respectively. The mid-market price of the Company’s shares at 31 December 2012 was £1.90.

At 31 December 2012, the following Awards had been made to Executive Directors under the DEP:

| Award date | At 1 Jan 2012 Number |

Awards granted Number |

Awards exercised Number |

Awards lapsed Number |

At 31 Dec 2012 Number |

Earliest exercise Date |

Latest exercise Date |

Jonathan Copus |

|||||||

|---|---|---|---|---|---|---|---|

| 31/10/111 | 50,121 | – | – | – | 50,121 | 31/10/13 | 31/10/14 |

- The number of shares subject to the Share Award was adjusted by increasing the original Share Award by 24.1% to reflect the rights issue which took place on 17 May 2012. The adjusted numbers are quoted in the table above.

Notes

- A one-off Award under the DEP was made to Jonathan Copus as part of a recruitment incentive.

- Awards are in the form of a nominal cost option and no payment is required for the grant of an Award. However, participants who are granted nominal cost options under the DEP are required to pay the Company the nominal value of £0.10 for each share issued upon the exercise of the option;

- There are no performance conditions attaching to the vesting of the Awards.

- Awards vest on the second anniversary of the date of grant.

- Further details of the DEP are contained in note 28 to the accounts

Approval

The Directors’ Remuneration Report has been approved by the Board of Directors of the Company.

Signed on behalf of the Board.

Robert Cathery

Chairman of the Remuneration Committee

13 March 2013

The Directors are responsible for preparing the Annual Report and the Financial Statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare Financial Statements for each financial year. Under that law the Directors are required to prepare the Group Financial Statements in accordance with International Financial Reporting Standards (IFRSs) as adopted by the European Union and Article 4 of the IAS Regulation and have also chosen to prepare the Parent Company Financial Statements under IFRSs as adopted by the EU. Under company law the Directors must not approve the accounts unless they are satisfied that they give a true and fair view of the state of affairs of the Group and of the profit or loss of the Group for that period. In preparing these financial statements, International Accounting Standard 1 requires that Directors:

- properly select and apply accounting policies;

- present information, including accounting policies, in a manner that provides relevant, reliable, comparable and understandable information;

- provide additional disclosures when compliance with the specific requirements in IFRSs are insufficient to enable users to understand the impact of particular transactions, other events and conditions on the entity’s financial position and financial performance; and

- make an assessment of the Group’s ability to continue as a going concern.

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Group’s transactions and disclose with reasonable accuracy at any time the financial position of the Group and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the Group and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity of the corporate and financial information included on the Group’s website. Legislation in the United Kingdom governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions.

Directors’ responsibilities statement

We confirm that to the best of our knowledge:

- the financial statements, prepared in accordance with International Financial Reporting Standards as adopted by the EU, give a true and fair view of the assets, liabilities, financial position and profit or loss of the Company and the undertakings included in the consolidation taken as a whole; and

- the business review, which is incorporated into the Directors’ Report, includes a fair review of the development and performance of the business and the position of the Company and the undertakings included in the consolidation taken as a whole, together with a description of the principal risks and uncertainties that they face.

By order of the Board

James Menzies

Chief Executive Officer

13 March 2013

Dr Jonathan Copus

Chief Financial Officer

13 March 2013